What is the best time to break even? This is one of the most important questions to ask when starting a business. It’s important to do a break-even analysis. This will help you establish fixed and variable costs, such as rent and materials. You can then set your prices accordingly and forecast when your business will be profitable.

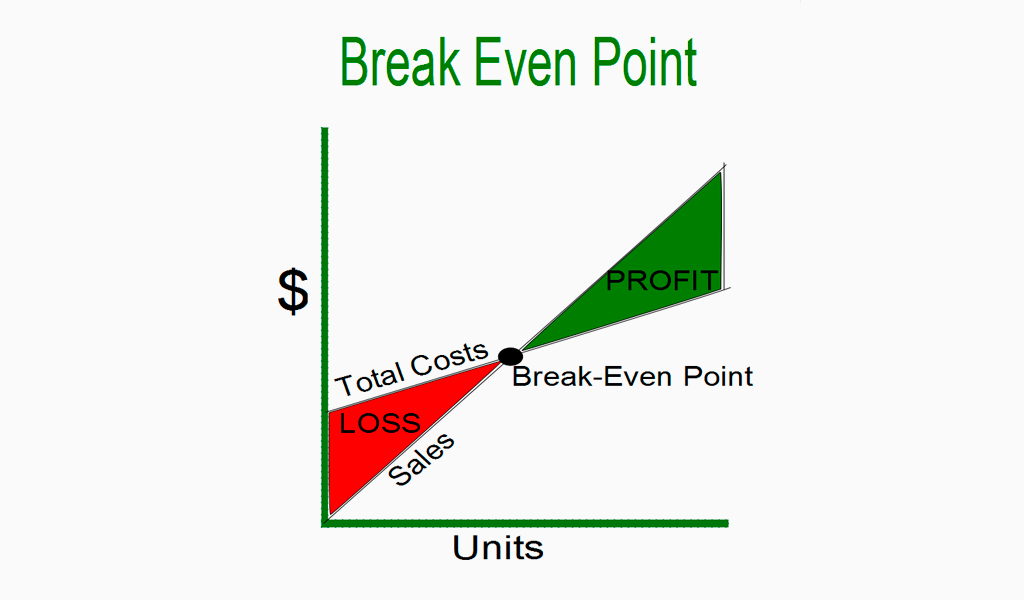

The concept of the Break-Even Point (BEP) is central to the analysis of break-even.

Table of Contents

What is the breakeven point of a business?

The point at which revenues equal costs is called the break-even point. Once you have determined that number, it is time to examine all costs, from rent to labor to materials, as well as pricing.

Ask yourself these questions: Are you setting too low a price or too high a cost to reach break-even in a reasonable time frame? Is your business viable?

Five Steps to Create a Break-Even Analysis

These are the steps you need to follow to determine a breakeven:

- Calculate variable unit costs: Find out the variable costs involved in producing one unit of this product. Variable cost refers to the costs of making or purchasing wholesale. You will need to know how much each component costs when you make a product. If you print books, for example, the variable unit costs of paper, binding, glue, and glue per book and the total cost to put it together are your variable unit costs.

- Fix your fixed costs. Fixed costs are the costs that you incur to keep your business running, even if there is no product production. Add up the monthly cost of running your factory. These costs include rent, mortgage, utilities and insurance. You should also consider the costs of designing the product, packaging, making the prototype, and patenting your product.

- Calculate the unit selling cost: This is how you determine the selling price of your product. As you determine your break-even point, this price could change.

- Calculate the sales volume and unit prices: As the product’s sales volume changes, so will the break-even point.

- You will need to create a spreadsheet in order to calculate break-even. It will calculate break-even points for each level of product price and sales volume, then create a graph.

Break Even Analysis: Formula

This is the formula for breaking even analysis:

Break-even quantity = Fixed costs / (Sales price per unit – Variable cost per unit)

Where:

- Fixed costs are those costs that don’t change with the output of an organization (e.g., salaries, rent, or building machinery).

- The selling price (or unit selling price) is the unit’s sales price.

- Variable cost per unit refers to the variable costs that were incurred in order to create a unit.

It is also useful to remember that the contribution margin is equal to the sales price per unit. If a book sells for $100, and the variable costs to make it are $5, then $95 is the contribution margin per unit and helps offset the fixed costs.

Example of Break Even Analysis

Colin is Company A’s managerial accountant. He sells water bottles. He had previously calculated that Company A’s fixed costs include property taxes, a lease and executive salaries. These amounts add up to $100,000. A single water bottle costs $2 each. The premium water bottle sells for $12. The break-even point for Company A’s premium water bottles is:

Break-even quantity = $100,000 / ($12 – $2) = 10,000

Given the fixed costs, variable cost, and the selling price for the water bottles, Company A would have to sell 10,000 water bottles in order to break even.

How to use a break even analysis

You can calculate your break-even point with a break-even analysis. This is just the beginning of your calculations. You might discover that you need to sell more products to break even.

This is where you should ask yourself if your current plan is feasible if you can raise prices or find a way to cut costs or both. It is important to consider whether your products are going to be successful on the market. Although the break-even analysis will determine how many products you need, it doesn’t guarantee that your products will sell.

This financial analysis should be done before you open a new business to get a clear picture of the risks involved. This means that you need to determine if the business is worthwhile. This analysis should be done by existing businesses before they launch a new product/service to determine if the potential profits are worth the startup cost.

The end result

A break-even analysis is crucial for smart business decisions. Do a break-even analysis the next time you are thinking of starting a business or changing your business.

I’m a product and graphic designer with 10-years background. Writing about branding, logo creation and business.